Digital Marketing Landscape in Australia

Australia’s GDP and Key Economic Trends

Australia is the key economy in the Asia-Pacific market, with a GDP of $1.39 trillion as of 2019. This represents an increase of almost $0.2 trillion since 2017, when Australia’s economy suffered a slump. But it remains lower than the high point of $1.58 trillion seen back in 2013.

The country, as well as the rest of Oceania and the Pacific Ocean region, has not been left unscathed by COVID-19. It has implemented high levels of control and restriction at various points throughout 2020 in order to keep the pandemic at bay. Of course, this has led to economic hardship in some areas – the cost of which remains to be fully counted. As such, it is hard to predict the trajectory of Australia’s GDP in the coming years.

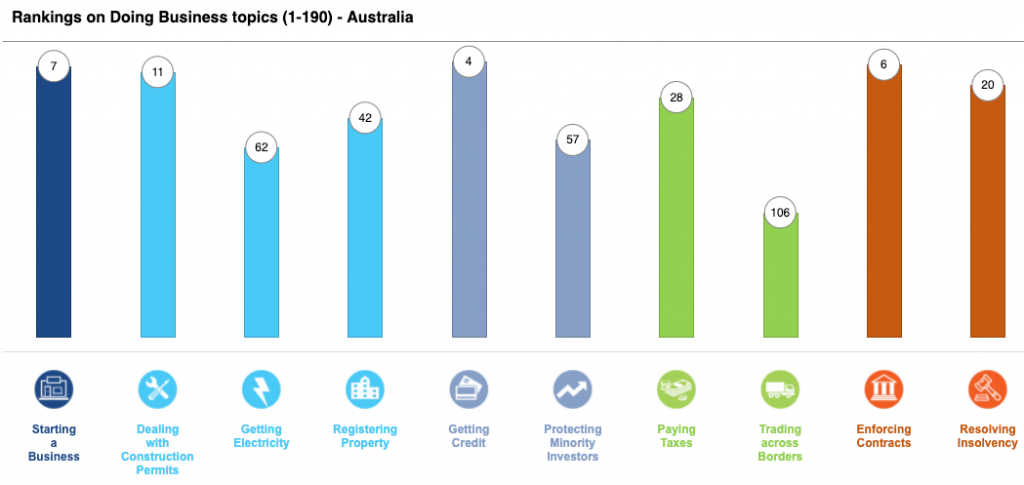

Australia is still a welcoming place for foreign investors, however. The country ranks 14th in the world on the Doing Business list. And, it achieves a score of 81.2%, thanks to the relative ease of starting a business, gaining credit, and enforcing contracts. Doing Business also noted that recent regulatory changes have made it easier for business owners to get the credit they need.

It is worth noting other changes in Australia across recent years and decades, including social ones. After increasing sharply throughout the 1980s and 1990s, Australia’s median age is now leveling out, increasing from 38.8 in 2017 to 39.1 in 2019. We have seen the same trend with Australia’s life expectancy, which has leveled out at between 82 and 83.5 years since 2015. These factors combine to give Australia a stable base of adults of working age – a great resource for any prospective business owner to tap into.

The Pros and Cons of Doing Business in Australia

Source: https://www.doingbusiness.org/en/data/exploreeconomies/australia

Advantages of doing business in Australia

- The official language of Australia is English, which may make the country feel more familiar to foreign investors and the environment easier to navigate.

- Australia has a well-developed digital and physical infrastructure, which means that much of what you need to start your business is already in place within the country.

- Australia’s workforce is well-educated and experienced, providing businesses such as digital marketing firms with a broad pool of potential candidates.

- The political situation of Australia is known to be highly stable, offering reliability and peace of mind to foreign investors.

Disadvantages and challenges associated with doing business in Australia

- Registration can be tricky and protracted in Australia. For example, registering your business premises with the relevant authorities and setting up import and export capabilities for your business can be complicated procedures.

- Business owners must apply for a connection to the local power grid, which can delay operations.

- While the internet is broadly available across the country, Australia’s broadband connection speeds are notoriously slow.

- Australia’s land area is comparable to that of the lower 48 states, although its interior is much more sparsely populated. This can make logistics difficult at times.

Crafting a Digital Marketing Strategy in Australia

At the end of 2019, there were 20.32 million active internet users in Australia, translating to 88% of the population. This is a major resource for digital marketers and represents a huge audience that these marketers can tap into. This high level of internet usage is largely thanks to the rapid development of Australia’s broadband network in the last decade. The National Broadband Network was established in 2009. It is designed to provide all Australians with internet access they need to live connected, prosperous lives in the modern world.

What’s more, the NBN is designed to provide an economic boost across Australia. With the right digital infrastructure in place, Australia – and Australians – can reap the rewards of a flourishing digital economy.

However, as mentioned above, Australia is still encountering challenges in relation to its broadband network. For example, while broadband adoption is widespread, fiber optic technology is not. There is currently an adoption rate of only 10% for fiber broadband in Australia, something that is restricting development in the country.

Lack of fiber optic infrastructure is not necessarily an obstacle. Smartphones are now leading the way in terms of internet usage in Australia, and 47.5% of browsing now takes place on these handheld devices, compared to 45.3% on laptops and desktop PCs and 7.1% on tablets. For users of most mobile carriers, however, 5G is still restricted to the major population centers of Sydney, Canberra, Melbourne, Brisbane, Adelaide, and Perth.

Among smartphone users, Android continues to be the dominant operating system, although its market share has fallen a little in recent years. In 2020, 58.8% of users are on Android devices, down from 63.5% in 2019 and 61.8% in 2018. Android’s loss is Apple’s gain, it appears, as iOS-supported devices are now used by 41.4% of the population, up by 5% last year. Windows phones make up 0.1% of the market, down from 0.9% two years ago.

Considering Government Policy

Australia has recently started ensuring that international eCommerce companies operating in the country collect goods and services tax (GST) on all Australian sales. This makes doing business a little more difficult, complex, and expensive for international organizations.

Other changes to government policy and legislation include updated regulations regarding search engines and social networking sites (SNS). The proposed legislation will require SNS and search engines to pay Australian-based news organizations and publishers when they index or share articles from these sources. This may have a knock-on effect on the cost and availability of paid advertising via search engines and social media.

The Digital Experience in Australia

Australia’s population is highly engaged with social media. The most popular social media platforms are:

- Facebook, with 17 million unique users each month

- YouTube, with 15 million unique visitors each month

- Instagram, with 9 million monthly active users.

- Snapchat, with 6.4 million different monthly users

In terms of search engines, these are the providers that digital marketers need to be targeting:

- Google, with a 94% market share

- Bing with a 3.5% market share (plus 0.72% provided by MSN Australia)

- DuckDuckGo with a 0.54% market share

- Yahoo with a 0.52% market share.

As Australians move away from more traditional forms of digital communication such as SMS, instant messaging apps are gaining traction. There is little current user data available, but it appears that WhatsApp is one of the most dominant messaging apps with 7 million monthly users in Australia.

For search engines, the message is clear – digital marketers are best served pursuing the best possible optimization on Google’s Search Engine Result Pages. However, for social media – another crucial facet of a strong digital marketing strategy – a more diverse approach is required. Marketers need to get to know their audience and reach them across the appropriate platforms. They also need to stay on top of shifting public opinion regarding social media and to take advantage of new trends and channels as they emerge.

Australia’s Digital Advertising Market and COVID-19

While the digital economy has served as something of a lifeline during the COVID-19 crisis, this does not mean the market has emerged unscathed. Uncertainty regarding the short and long-term future of business in Australia has led to cautious behavior among advertisers, many of whom have reduced their net spend this year.

Back in August 2020, online advertising posted a 12% year-on-year decline. This slump was caused by 9% reductions in search and directory advertising spend, as well as an 11% dip for general display ads and a 22.7% fall in classified ad spend. However, video advertising bucked the trend, providing significant encouragement for advertisers as it increased its market share to over 50%.

This slump was greater than expected. Two months earlier, Magna released their own forecast for Australia’s digital advertising market, predicting an 8% decline. However, despite this decline, the continuing strength of video advertising provides hope for digital marketers and hints at a period of recovery and resilience to come.

Learn More About Digital Marketing in Australia

To learn more about digital marketing and advertising with social media in Australia and Oceania or elsewhere in the Asia-Pacific region, contact us at Principle.

About Principle

Principle helps businesses of all sizes make better decisions through data. For the better part of a decade, we have helped global brands and Fortune 500 companies turn data into intelligence and actionable insights they can use in digital marketing.

Our team of 100 employees includes experts across Analytics, Paid Marketing, SEO, and Data Visualization. We offer actionable and measurable data analytics strategies, SEO, and campaign management services that deliver the digital transformation your business needs to outperform the competition.

We recruit independent professionals who have their own personality, an established way of life, a unique skill, and can share our philosophy. With such colleagues, we believe that individuals and companies will grow together and achieve great quality and result in an unseen business world.

To learn more about digital marketing and advertising in Japan or elsewhere in the Asia-Pacific region, feel free to contact us at Principle.

Want to grow your business in Asia?

Principle is a data-driven marketing agency that grows your business in Japan and the rest of the Asia Pacific market. Click here to learn more about our digital marketing services for the APAC region.